InsurTech4Good Weekly Newsletter – #8, 2025

Hello to everyone who is into insurance innovation and regulation.

Here is a summary of the most important regulatory and policy news that caught my attention last week.

Apologies for sending it on Tuesday, but yesterday we celebrated Estonian Independence Day.

As always, I welcome your feedback and appreciate it if you share this with those who might also benefit from it.

Andres

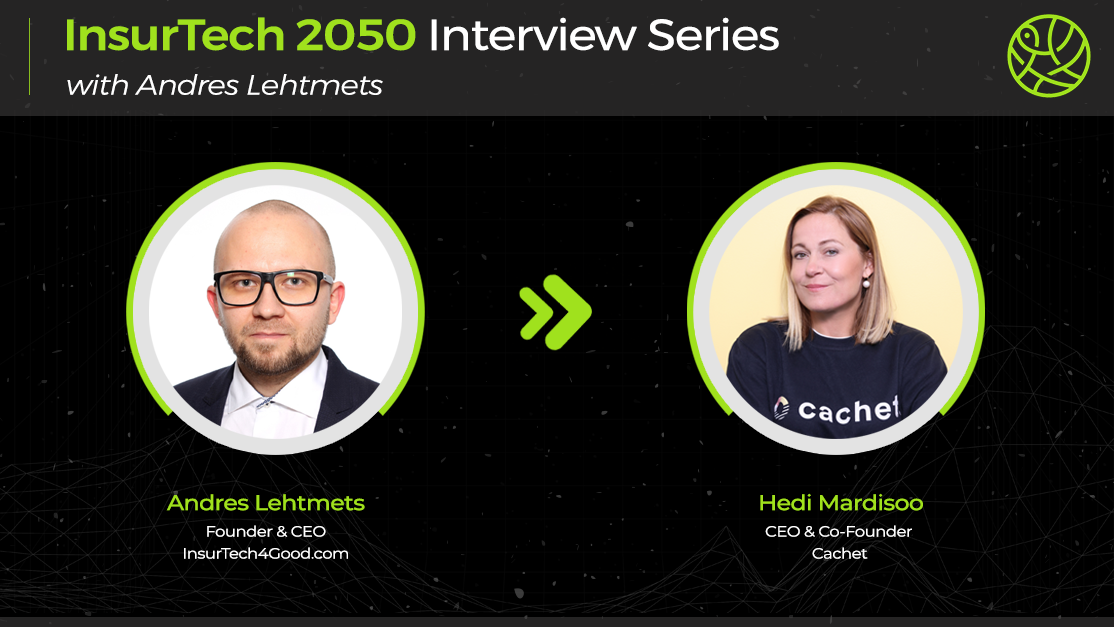

InsurTech 2050 Interview of the Week | Hedi Mardisoo, Cachet

The second interview in the InsurTech 2050 series features Hedi Mardisoo from Cachet.

We discussed data-driven insurance, the future of mobility, the gender gap in insurance, the importance of a human-centric approach, and much more. It’s a longer read, but well worth your time.

Read the full interview here.

AI literacy and insurance

Do you want to learn more about the European Union’s approach to Article 4 of the AI Act and explore the ongoing practices of AI Pact organisations? Then re-watch this webinar.

Article 4 of the AI Act, which requires providers and deployers of AI systems to ensure a sufficient level of AI literacy, came into effect on 2 February 2025.

In the first part of the webinar, the EU AI Office focused on Article 4 and its requirements, presenting planned initiatives to support the implementation of this general provision.

During this session, the AI Office launched a living repository containing an initial, non-exhaustive list of ongoing practices gathered from AI Pact members. This repository will be regularly updated.

While compliance with the practices included in this repository does not automatically imply conformity with Article 4, it aims to foster learning and exchange among providers and deployers.

In the second part of the webinar, various practices and key insights were discussed in an interactive dialogue between the EU AI Office and AI Pact members, including representatives from the insurance industry.

Read more on EU AI Act AI Literacy Practices in insurance here.

Better data-sharing in finance

The European Parliament and Council have reached a political agreement on the Commission’s proposal to enhance data-sharing and reduce redundant reporting in EU financial services.

Part of the Commission’s broader strategy to modernize supervisory data collection, the new rules aim to streamline reporting, improve governance, and leverage modern technologies.

Authorities will now share data more efficiently, reducing duplicate requests to financial institutions. The 'report-once' principle ensures that authorities request existing data from each other instead of directly from firms, minimizing administrative burdens.

The provisions also cover processed data to prevent redundant data cleaning efforts across agencies.

To further simplify reporting, the European Supervisory Authorities (ESAs) will advance their work on integrated reporting by developing a roadmap for a cross-sectoral system.

They will also regularly review and eliminate redundant requirements to minimize reporting burdens. Additionally, new rules will promote data reuse for research and innovation.

Read more here.

Insurance and the Longevity Economy

Rising life expectancy and declining birth rates pose new societal challenges.

Health systems are under strain, and financial security is at risk as savings must last longer.

These challenges pave the way for innovation and fresh thinking on the protection role of insurance.

Life and health insurers help people manage financial and health risks.

However, traditional products must evolve to better align health spans (years in good health) and wealth spans (years with sufficient financial resources) with longer life spans.

This report examines the socioeconomic impact and public perception of longevity, drawing on a global survey of 15,000+ people.

While awareness of longevity risks is high, many overestimate their preparedness.

The report highlights how insurers can adapt, develop new solutions, and collaborate with policy makers to build a resilient longevity economy.

Read more here.

European Financial Data Space

Do you know what the European Financial Data Space is? The purpose of European data spaces is to make a wider range of data available for access and reuse, with the goal of creating a single market for data that ensures Europe’s global competitiveness.

Finance is one of the key sectors where the integration of open data is reshaping how individuals and institutions interact with financial services.

The development of the European Financial Data Space (EFDS) is revolutionizing financial data management and improving interoperability across Europe.

It consists of three pillars:

- European Single Access Point (public reporting data)

- Framework for Financial Data Access (private customer data)

- Supervisory Data Strategy (supervisory reporting data)

See full recording of the Financial Data Spaces webinar here.

The Open Finance Sprint

The Open Finance Sprint will take place on 27–28 March 2025 at the Financial Conduct Authority (FCA) office.

The UK has led in open banking, allowing consumers and businesses to share payment account data for tailored services.

Open finance extends this to savings, insurance, mortgages, investments, pensions, and credit, offering significant benefits.

Building on past initiatives, this Sprint will explore the future technological and regulatory framework for Open Finance.

Participants will collaborate on future-focused use cases within a smart data economy, addressing four problem statements:

- Optimizing credit data for better financial wellbeing and debt management.

- Empowering financial decisions through data-driven insights.

- Enhancing consumer resilience for key life events.

- Mystery use case (revealed on 27 March).

Read more here.

ENISA Threat Landscape: Finance Sector

This is the first analysis conducted by the European Union Agency for Cybersecurity (ENISA) of the cyber threat landscape of European finance and insurance sector.

From January 2023 to June 2024, the European financial sector faced significant cybersecurity challenges, highlighting threats and vulnerabilities across the sector.

The report states that stakeholders in the finance sector should invest strategically to improve cybersecurity resilience.

This involves investing in supply chain management and incident response.

Strengthening regulatory compliance with frameworks,

like the general data protection regulation (GDPR), the network and information security directive, and the Digital Operational Resilience Act (DORA) is essential, alongside implementing comprehensive employee training programmes and robust incident response plans.

Rigorous third-party risk management practices are crucial, as is fostering collaboration and information sharing within the sector.

A multifaceted approach is necessary to stay ahead of evolving cyber threats and maintain long-term resilience.

Read more here.

Evidence-Based Insights on the Impact of Financial Inclusion

CGAP has developed Impact Pathfinder—a platform designed to help you navigate the latest evidence on financial inclusion.

What can this platform do for you? You can explore insights on where financial inclusion efforts are most effective, for whom, and how.

- Discover how impact happens – Understand how financial services contribute to development outcomes.

- Uncover influencing factors – Learn why the impact of financial services varies across different contexts.

- Identify research gaps – Explore areas where evidence is conflicting or missing.

- Understand customer needs – Gain insights into what drives greater adoption and use of financial services across different customer groups.

Read more here.

Thank you!

Thanks for reading! If you need help with regulatory strategy, InsurTech research, thought leadership, or policy advisory, feel free to reach out on LinkedIn or via email.

Member discussion