InsurTech4Good.com Weekly Newsletter – #16, 2025

Hello to everyone who is into insurance innovation and regulation.

I hope you had a refreshing Easter break and are back at full speed. Mine was a bit unusual—I completed the world’s biggest paddling marathon! If you're curious about that adventure, you can read more here.

Still on a personal note, next week, I’ll be speaking at the Global InsurTech Summit in London. I have two complementary passes—let me know if you'd like one (first come, first served).

Also happy to connect while I’m in town! Let’s talk regulation, InsurTech strategy, or just grab coffee.

Now to the news. Hope you enjoy the read!

—Andres

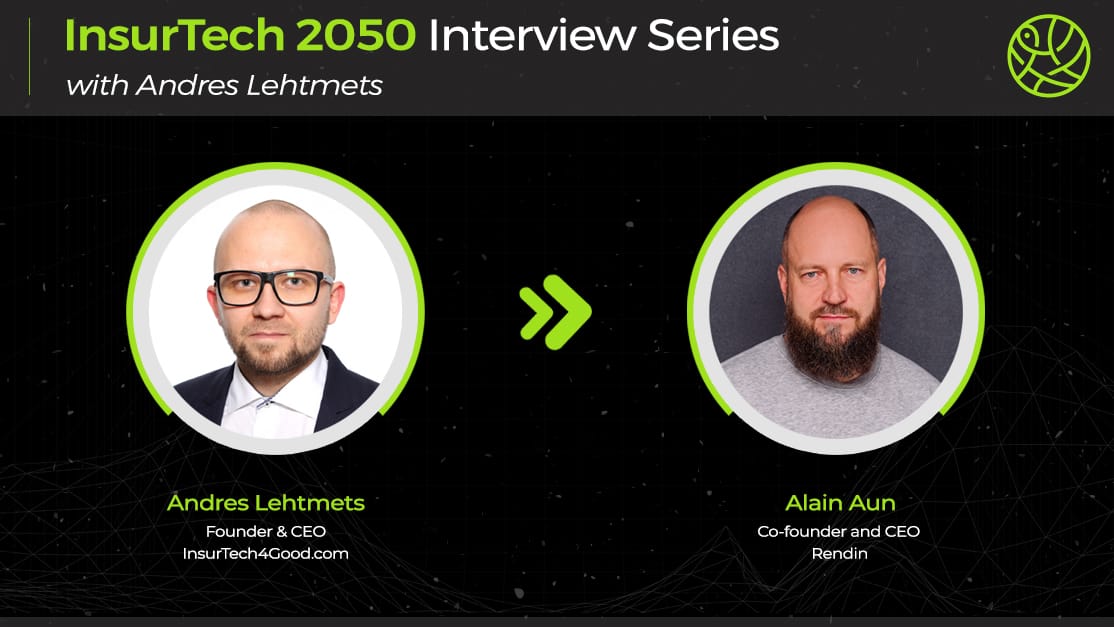

InsurTech 2050 interview of the week | Alain Aun from Rendin

Rendin has built something in the InsurTech space that I’ve personally been using since day one—and they’re now aiming to revolutionize Europe’s long-term home rental market, which is around 25 times larger than Airbnb’s current market.

I’m very happy to share our in-depth conversation with Rendin co-founder and CEO Alain Aun. It’s honest, direct, and insightful—for both the insurance community and regulators.

We talked about innovation in insurance, regulation, moving towards the model of “we’ll make sure nothing bad happens—and if it does, we’ll take care of it for you”, the role of AI, and much more. I highly recommend you take the time to read it.

Also—they're currently looking for an insurer to support and partner with them in their pan-European expansion (I know many potential names among my readers' network), as well as an investor ready to join an ambitious, expensive, and long journey to reshape the home rental market.

Read full interview here.

How insurers can supercharge their strategy with AI

BCG has published an article on AI strategy in insurance. The paper states that AI empowers insurers to accelerate progress toward existing goals and to set even more ambitious targets for the future.

However, success requires keeping three key principles in mind:

1. Don’t overstrategize the technology. Instead, use AI to narrow your bets and sharpen your competitive edge where it matters most.

2. Push hard for near-term P&L impact. Focus on transforming a few high-value functions and avoid subscale implementations.

3. Don’t get stuck in a tech silo. AI initiatives require business leadership and meaningful investment in people and processes.

Read more here.

AI in finance and insurance

The rapid progress in AI—particularly the emergence of generative AI models—has generated both excitement and concern about the potential consequences of this new technology.

In the financial industry, there has been, and continues to be, hope that AI will significantly improve efficiency in a sector with a mixed track record on productivity and performance.

This report will examine some of the ways AI is currently being used in the industry and assess whether it has the potential to deliver substantial productivity gains.

Read more here.

EDPB adopts guidelines on processing personal data through blockchains

When I was leading the blockchain/DLT implications for insurance workstream at EIOPA some years ago, data protection—particularly GDPR-related issues—frequently emerged as a key area of uncertainty and a potential barrier to innovation.

For example, some solutions never progressed beyond the proof-of-concept stage due to significant legal uncertainty surrounding data protection legislation.

In the diagnostic work, we also highlighted the importance of engaging with other supervisory authorities beyond the insurance domain, including data protection bodies.

That’s why I’m pleased to see that the European Data Protection Board (EDPB) has just adopted guidelines on the processing of personal data through blockchains.

The Board emphasises the importance of supporting organisations in ensuring compliance with the GDPR when using these technologies. The guidelines explain how blockchain works, assess various architectures, and examine their implications for personal data processing.

Key points include the need to implement technical and organisational measures from the earliest design stages, and to assess the roles and responsibilities of all actors involved in blockchain-related processing of personal data.

Organisations are also advised to conduct a Data Protection Impact Assessment (DPIA) before initiating blockchain-based processing where a high risk to individuals’ rights and freedoms is likely.

The EDPB stresses that personal data should not, by default, be accessible to an indefinite number of people. The guidelines provide examples of techniques for data minimisation, as well as approaches for handling and storing personal data.

As a general principle, storing personal data on a blockchain should be avoided where it would conflict with data protection rules.

Finally, the Board underscores the importance of upholding individuals’ rights—particularly in terms of transparency, rectification, and erasure of personal data.

Read more here.

Thanks for reading!

If you're navigating InsurTech regulation, policy, or innovation—and think I can help—don’t hesitate to get in touch.

📬 Subscribe to my newsletter here

📌See how I can help you here

🔗 Follow me on LinkedIn

📧 andres@insurtech4good.com

Member discussion